Blog

In this listicle roundup, we share the most important online shopping statistics that explain how e-commerce is growing and how people buy online today. The data covers market size, shopper adoption, mobile usage, payments, platforms, and purchase behavior.

We collect all data from trusted online sources, and every source URL is attached at the end of the article for transparency. This guide helps marketers, founders, and teams understand trends, spot opportunities, and make informed ecommerce decisions using the latest online shopping statistics.

Key online shopping takeaways

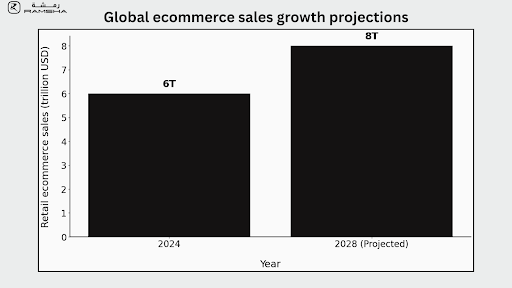

- Global ecommerce sales reached six trillion U.S. dollars in 2024 and are projected to grow 31% to nearly eight trillion dollars by 2028, confirming strong long-term momentum.

- Asia generated nearly two trillion U.S. dollars in e-commerce revenue in 2024, making it the largest regional online shopping market globally.

- By 2028, more than half of the global population aged 14 and above will be ecommerce shoppers, showing mass adoption of online buying.

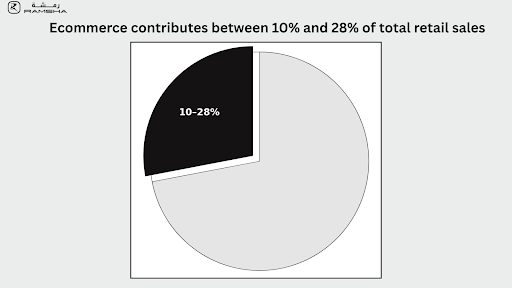

- E-commerce already accounts for 10 to 28% of total retail sales in advanced markets such as the UK, US, and Switzerland.

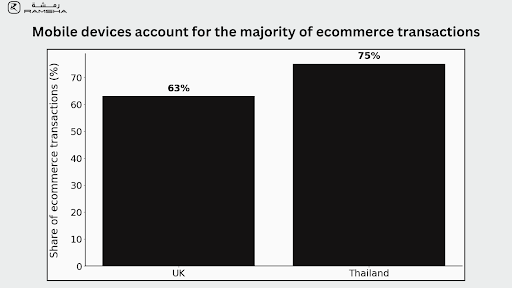

- Mobile commerce dominates, with 63% of transactions in the UK and 75% in Thailand completed on smartphones.

- 4.11 billion people purchased consumer goods online in 2022, highlighting the global reach of e-commerce according to recent online shopping statistics.

- Online cart abandonment reached 70% in 2023, indicating significant friction at checkout and during purchase completion.

- Free delivery encourages 49.4% of internet users to complete an online purchase, making delivery cost a critical conversion factor.

- Social media influences 42% of consumers’ purchasing decisions, confirming social platforms as key commerce channels.

- 76% of consumers say a poor delivery experience would affect their decision to order again, directly linking fulfillment quality to retention.

Global e-commerce market size and growth

The data here sets the scale of online shopping worldwide. These online shopping statistics show how much revenue ecommerce already generates and how fast it is expected to expand in the coming years.

- In 2024, global retail e-commerce sales reached six trillion U.S. dollars, showing the current size of online retail worldwide, and projections show 31% growth to nearly eight trillion U.S. dollars by 2028.

- Most countries across both mature and emerging markets recorded ecommerce growth of 6 to 15% CAGR through 2024, showing a continued global shift from offline to online shopping.

- Worldwide e-commerce revenue is projected to reach USD 3,647 billion in 2024, with a 9.83% CAGR from 2024 to 2028, indicating sustained long-term expansion.

- In the United States, the number of online shoppers grew by 5.6% in 2024, slower than 7% in 2022 and 6.1% in 2023, signaling market maturity.

- A consumer survey shows that 42% of consumers plan to spend more online over the next 12 months, supporting continued demand growth.

E-commerce store growth curve since 2019 (live domains)

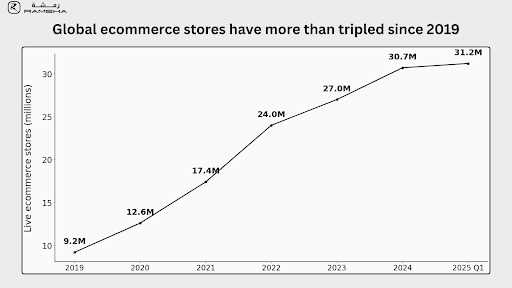

The number of live e-commerce stores has more than tripled since 2019, showing rapid platform and merchant expansion in these online shopping statistics.

| Year | Live stores | YoY Δ |

|---|---|---|

| 2019 | 9.2 M | — |

| 2020 | 12.6 M | 0.37 |

| 2021 | 17.4 M | 0.38 |

| 2022 | 24.0 M | 0.38 |

| 2023 | 27.0 M | 0.13 |

| 2024 | 30.7 M | 0.14 |

| 2025 Q1 | 31.2 M* | 0.02 |

Regional ecommerce revenue and market performance

Revenue figures across regions reveal clear differences in maturity and momentum. These online shopping statistics help compare established markets with fast-growing ones.

- Asia generated nearly two trillion U.S. dollars in e-commerce revenue in 2024, outperforming both the Americas and Europe in total online sales value.

- The Philippines and India are the fastest-growing e-commerce markets, with online sales growth expected to exceed 20% as digital adoption accelerates.

- E-commerce contributes 10 to 28 % of total retail sales in advanced markets such as the UK, US, and Switzerland, showing online retail is a core channel.

- In Bulgaria, e-commerce accounts for 8% of total retail sales, compared to 15% in Poland, indicating lower but rising penetration.

- Bulgaria’s e-commerce market has doubled over the past 4 years, reflecting rapid expansion from a smaller base.

Online shopper penetration and population adoption

Adoption levels show how deeply e-commerce has entered everyday life. These online shopping statistics show that higher penetration signals maturity.

- By 2028, more than 50% of the global population aged 14 and above will be e-commerce shoppers, indicating mass adoption.

- In the UK, 84% of citizens shop online, making it one of the most digitally mature ecommerce markets globally.

- In the US, 77% of online shoppers support an ecommerce market valued at USD 1.1 trillion.

- In the Philippines, online shopping penetration is around 40%, but continues to rise due to mobile and social commerce.

- In China, 64% of the population shops online, leaving a sizable portion still offline.

- In 2022, 4.11 billion people worldwide purchased consumer goods online, representing the global online shopping population.

- 70% of the U.S. population shops online, confirming e-commerce as a mainstream behavior.

Average overall online monthly spend (grocery + non-grocery)

Current online shopping statistics indicate that most online shoppers spend between $251 and $1,000 per month.

| Monthly online spend range | Share of respondents |

|---|---|

| $0 | |

| $1–$250 | |

| $251–$500 | |

| $500–$1,000 | |

| $1,001–$2,000 | |

| $2,000+ |

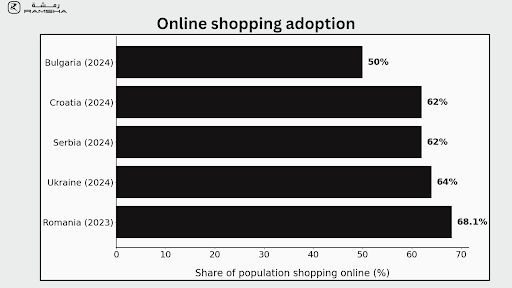

Country-level ecommerce adoption in Europe

Long-term adoption trends across European countries highlight steady progress. These online shopping statistics help track the growth of trust over time.

- In Bulgaria, 50% of people aged 16–74 are forecast to shop online in 2024, up from 22% in 2019.

- In Romania, 68.1% of internet users made online purchases in 2023, with increased adoption in rural areas.

- In Serbia, 62% of people aged 16–74 are expected to shop online in 2024, up from 34% in 2019.

- In Ukraine, online shopping adoption among ages 16–74 rose from 51% in 2019 to 64% in 2024.

- In Croatia, 62% of people aged 16–74 are forecast to shop online in 2024, compared to 45 % in 2019.

Leading e-commerce companies and marketplaces

Market leadership data highlights which platforms dominate. These online shopping statistics explain why marketplace models play a central role.

- Amazon is the largest e-commerce company globally, with nearly 800 billion U.S. dollars in gross merchandise value in 2024.

- In 2024, Amazon.com generated 152.8 billion dollars, JD.com 117.8 billion, Walmart.com 77.6 billion, and Apple’s D2C channel nearly 49 billion dollars in online revenue.

- 61% of Amazon’s total sales are generated by third-party sellers, highlighting the marketplace’s dependence on them.

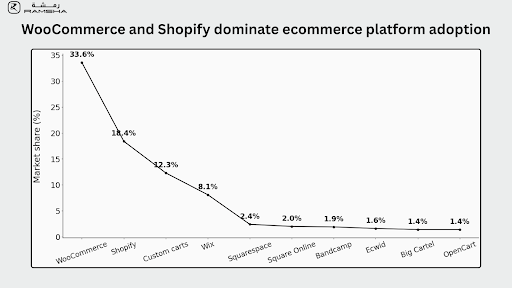

E-commerce platform market share (merchant count)

WooCommerce and Shopify dominate merchant adoption, together supporting more than half of all ecommerce stores.

| Platform | Stores | Market Share |

|---|---|---|

| WooCommerce | 4,650,399 | |

| Shopify | 2,546,886 | |

| Custom carts | 1,702,750 | |

| Wix | 1,123,383 | |

| Squarespace | 338,257 |

Mobile commerce and device usage

Shopping behavior across devices shows a clear shift toward smartphones. Online shopping statistics show why mobile-first experiences are now essential.

- Mobile commerce accounts for 63% of ecommerce transactions in the UK and 75% in Thailand.

- 45.2% of internet users globally make at least one online purchase per week on a mobile phone.

- Countries with the highest weekly mobile shopping usage include South Korea, Thailand, Turkey, Indonesia, Mexico, the UAE, and India.

- In 2025, smartphones accounted for nearly 80% of global retail website visits and most online orders.

- 88% of consumers have at least one shopping app installed on their mobile phones.

Payment methods and checkout behavior

Payment preferences reveal how shoppers expect to complete transactions according to the latest online shopping statistics.

- Cards account for 52-68% of online transactions in markets such as the UK, Canada, Singapore, and Turkey.

- Digital wallets are expected to reach 35-45% market share in mobile-first economies like Hong Kong and New Zealand.

- 45% of global B2C ecommerce transactions are completed using digital or mobile wallets.

- 32% of B2C ecommerce transactions use debit or credit cards.

- 11% of e-commerce transactions are completed via bank transfers.

Cross-border ecommerce

International buying activity shows how comfortable consumers are with overseas sellers. Higher cross-border shares point to strong trust in global e-commerce platforms.

- Cross-border ecommerce accounts for 15-32% of total online sales in countries such as Canada, Denmark, Singapore, and Thailand.

- In Singapore, 55 % of e-commerce purchases are cross-border. This indicates that Small markets rely heavily on global sellers.

Social commerce and product discovery

Discovery patterns highlight the growing influence of social platforms. Shopping journeys now often begin with browsing and inspiration rather than direct search.

- 33% of UK consumers and over 50% of Thai consumers shop directly via social platforms.

- In 2023, social media influenced purchases for over 50% of U.S. shoppers, compared to 28% in Czechia.

- 58% of consumers discover products through social media.

- 42% of consumers say social media influences their purchasing decisions.

- Among consumers aged 18–34, 73% purchased via social media in the past year.

Conversion, order value, and cart behavior

Spending patterns and abandonment rates explain what happens during the final stages of a purchase. These metrics help identify where revenue is gained or lost.

- The UK reports an e-commerce conversion rate of 1.9 %, among the highest globally.

- In Q3 2025, shoppers spent an average of 2.61 dollars per visit across ecommerce sites.

- Sporting goods recorded an average spend per visit of 4.26 dollars, followed by active apparel at 3.29 dollars.

- Average order value increased from 118 U.S. dollars in September 2022 to 138 U.S. dollars in September 2024.

- In 2024, direct traffic produced 114 U.S.dollars, an average order value, while social commerce orders averaged under 86 dollars.

- Desktop gadget purchases recorded average order values above 160 dollars.

- In 2023, online cart abandonment reached 70 %, the highest since 2013.

Fulfillment, delivery, and purchase drivers

Consumer expectations around delivery, returns, and communication shape purchase decisions. Meeting these expectations plays a key role in repeat buying.

- 49.4% of internet users say free delivery encourages purchase completion.

- 37.9% cite coupons and discounts as purchase drivers.

- 31.6% say customer reviews increase purchase likelihood and reduce hesitation about products.

- 30.4% say easy returns encourage online purchases, as they reduce the risk of losing money on items you don’t like.

- 75% of consumers expect the same shopping experience across all channels.

- 79% say user-generated content influences purchase decisions.

- 76% say poor delivery experience affects repeat orders.

- 80% expect regular post-purchase communication.

- Free delivery and fast delivery rank as the top two reasons for choosing an online retailer.

E-commerce infrastructure and merchants

The scale of online stores and merchant categories shows how competitive e-commerce has become. These figures help assess market saturation and entry barriers.

- In Bosnia and Herzegovina, clothing, footwear, and sports accessories lead online purchases, followed by electronics and digital services.

- 34.4 % of webshops in Bosnia and Herzegovina operate exclusively online.

- As of April 2025, there are 30.7 million live e-commerce domains worldwide.

- 45 % of e-commerce stores are hosted in the United States, totaling about 14 million domains.

- Apparel accounts for 1.12 million ecommerce merchants, representing 8 % of all stores.

- E-commerce stores grew from 9.2 million in 2019 to 30.7 million in 2025, a 3.3× increase.

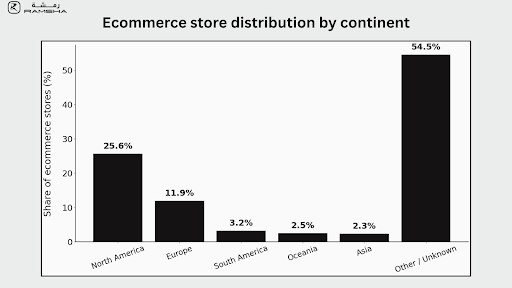

Ecommerce stores quantity by continent

Global e-commerce infrastructure is unevenly distributed, with North America and Europe hosting the largest share of online stores.

| Continent | Stores | % |

|---|---|---|

| North America | 3.54 M | |

| Europe | 1.65 M | |

| South America | 0.45 M | |

| Oceania | 0.34 M | |

| Asia | 0.32 M | |

| Other / Unknown | 7.55 M |

AI in e-commerce

Adoption data around AI highlights both opportunity and hesitation in the world of online shopping statistics. Usage levels show practical value, while concerns explain slower trust among some consumers.

- In 2024, nearly 25% of consumers had already used generative AI, and over 33% planned to use it in the future.

- 43% of consumers who are familiar with generative AI used chatbots while shopping online.

- Over 70% of Generation Z consumers show interest in AI shopping, compared to the global average of 50%.

- Three out of four consumers familiar with AI in e-commerce express concerns about bias.

- Nearly 70% of e-commerce companies report improved efficiency due to generative AI adoption.

- In 2024, consumer AI usage levels matched earlier findings, with nearly one quarter already using AI.

Environmental impact of e-commerce

Growth in deliveries and returns brings visible environmental costs. These figures help measure the sustainability pressure created by e-commerce expansion.

- By 2030, e-commerce delivery fleets may reach 7.2 million vehicles, producing 25 million metric tons of carbon emissions and increasing commute times to 64 minutes.

- In the US, ecommerce returns sent to landfills declined slightly in 2022, while return-related emissions dropped from 27 million to under 24 million metric tons.

Seasonal and short-term sales trends

Short-term spikes around major sales events reveal how demand concentrates during specific periods. These moments often drive a large share of annual revenue.

- The Census Bureau of the Department of Commerce announced that the estimate of U.S. retail e-commerce sales for the Q3 of 2025, adjusted for seasonal variation but not for price changes, was $310.3 billion, an increase of 1.9% (±0.4%) from the Q2 of 2025.

- Online sales during Black Friday and Cyber Monday 2023 increased 7.8% year over year, indicating a rise in online shopping during the peak days.

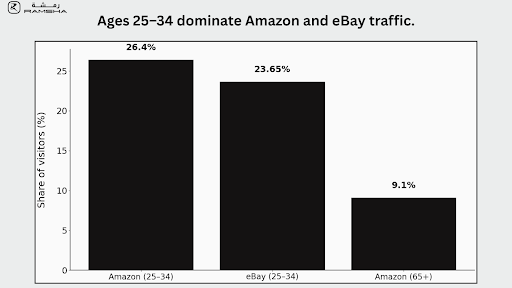

Product categories and demographics

Category and age data reveal who drives online shopping activity. Younger shoppers and apparel purchases are key drivers of e-commerce traffic.

- In the US, 43% of consumers buy clothing online, and 34% buy shoes.

- In August 2025, people aged 25–34 accounted for 26.4% of Amazon visitors and 23.65% of eBay visitors, while only 9.1% of Amazon visitors were aged 65+.

Final Words

Online shopping continues to scale while customer expectations keep rising. The online shopping statistics in this guide show where e-commerce is growing fast, where it is maturing, and where friction still exists across the buying journey. You can use this data to benchmark performance, plan market entry, improve mobile and checkout experiences, and strengthen delivery and retention strategies. What comes next is action. Apply these insights to test, optimize, and build ecommerce experiences that align with how people actually shop today.

FAQs

How big is the global online shopping market today?

Global e-commerce sales reached six trillion U.S. dollars in 2024. The market is expected to grow by 31% and reach nearly eight trillion dollars by 2028, showing strong long-term expansion.

Which region leads global e-commerce revenue?

Asia leads global e-commerce revenue, generating nearly two trillion U.S. dollars in 2024. This is higher than both the Americas and Europe.

How many people shop online worldwide?

In 2022, about 4.11 billion people purchased consumer goods online. By 2028, more than half of the global population aged 14 and above is expected to shop online.

Is e-commerce growth slowing in mature markets like the US?

Yes. In the United States, online shopper growth slowed to 5.6% in 2024, down from 7% in 2022 and 6.1% in 2023. This shows market maturity.

Why is mobile commerce so important?

Mobile devices account for most e-commerce activity. In the UK, 63% of transactions happen on mobile, while in Thailand the share is 75%. Nearly 80% of retail website visits come from smartphones.

What causes shoppers to abandon online carts?

Cart abandonment reached 70% in 2023. High delivery costs, complex checkout, lack of trust, and poor user experience are key reasons shoppers leave before completing purchases.

What factors most influence online purchase decisions?

Free delivery influences 49.4% of shoppers, while social media impacts buying decisions for 42% of consumers. Reviews, easy returns, and fast delivery also play major roles.

How does delivery experience affect repeat purchases?

Delivery quality strongly impacts retention. 76% of consumers say a poor delivery experience would affect their decision to order from the same retailer again.

Data Sources

- https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/

- https://www.emarketer.com/content/ecommerce-account-more-than-20–of-worldwide-retail-sales-despite-slowdown

- https://www.jpmorgan.com/content/dam/jpm/treasury-services/documents/global-e-commerce-trends-report.pdf

- https://ecommerce-europe.eu/wp-content/uploads/2024/10/CMI2024_Complete_light_v1.pdf

- https://www.statista.com/forecasts/860716/top-online-stores-global-ecommercedb/

- https://www.statista.com/statistics/239288/countries-ranked-by-average-b2c-e-commerce-spending-per-online-buyer/

- https://www.statista.com/statistics/1363180/monthly-average-units-per-e-commerce-transaction/

- https://www.statista.com/statistics/477804/online-shopping-cart-abandonment-rate-worldwide/

- https://www.statista.com/statistics/1034149/online-shoppers-sources-of-inspiration/

- https://www.statista.com/statistics/1459217/gen-ai-consumer-awareness-use-online-shopping/

- https://wearesocial.com/wp-content/uploads/2023/03/Digital-2023-Global-Overview-Report.pdf

- https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

- https://redstagfulfillment.com/how-many-ecommerce-stores-exist/

- https://www.statista.com/topics/871/online-shopping/

- https://www.statista.com/statistics/1459217/gen-ai-consumer-awareness-use-online-shopping/

- https://www.census.gov/retail/ecommerce.htmlhttps://cart.com/hubfs/2024-State-of-the-retail%20consumer.pdf?hsLang=en

- https://www.oberlo.com/statistics/how-many-people-shop-online-in-the-us

- https://www.statista.com/forecasts/997093/most-popular-categories-for-online-purchases-in-the-us/

- https://www.statista.com/statistics/1588364/age-distribution-of-visitors-to-online-stores/

Article By

Asif Hasan

Asif Hasan is a recognized expert in textile artistry, global sourcing, and e-commerce growth within the hand-knotted rugs and carpets sector. As the CEO of Ramsha Home, he focuses on preserving traditional weaving techniques while implementing modern digital strategies to bring authentic, high-quality floor coverings from artisan workshops to global customers. He specializes in optimizing the carpet supply chain and ensuring the sustainable trade of premium home textiles.

0

0