Blog

The UAE eCommerce market continues to grow rapidly, supported by high internet use, digital payments, and strong government initiatives.

With nearly every sector including fashion, electronics, food, and home décor moving online, the country stands out as a leader in digital retail.

This report presents the latest UAE eCommerce statistics and consumer insights for 2026.

We have curated the data from trusted industry sources, and all source URLs are listed at the end of this article for reference.

Key Statistics – UAE eCommerce Market 2025

- The UAE’s total eCommerce revenue is projected to reach US $7.5 billion in 2025.

- The market is expected to grow to between US $8.55 billion and US $20.54 billion by 2030, with a compound annual growth rate (CAGR) ranging from 2.67% to 12.39%.

- Business-to-consumer (B2C) sales accounted for 68% of total online revenue in 2024.

- The fashion category leads the market with a 22% share and contributes 38.7% of total eCommerce revenue.

- Smartphones drive 79% of all eCommerce transactions, confirming the UAE’s mobile-first shopping behaviour.

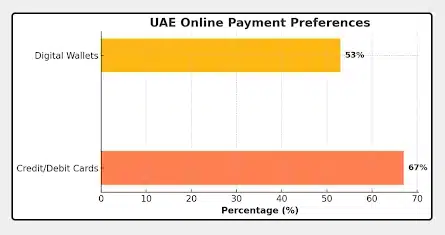

- Digital wallets achieved 53% usage in 2024, while 67% of consumers prefer using credit or debit cards for online payments.

- 94% of online shoppers in the UAE are under 34 years old, and 82% are male, indicating a young and tech-savvy customer base.

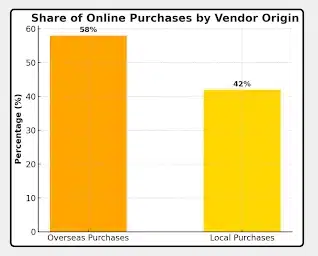

- 58% of online purchases are made from international vendors, showing strong cross-border buying activity.

- Dubai’s same-day delivery services now reach 90% of the city’s urban population, setting a regional benchmark for logistics efficiency.

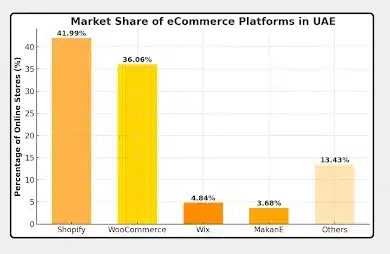

- Shopify powers 41.99% of all online stores in the UAE, followed by WooCommerce at 36.06%, making them the country’s two leading eCommerce platforms.

Market Overview and Growth

UAE eCommerce revenue projected to reach US $7.50 billion in 2025

Experts project that total online revenue will reach around US $7.50 billion in 2025. This shows how more people are choosing to buy products and services online due to better internet access and trust in digital payments.

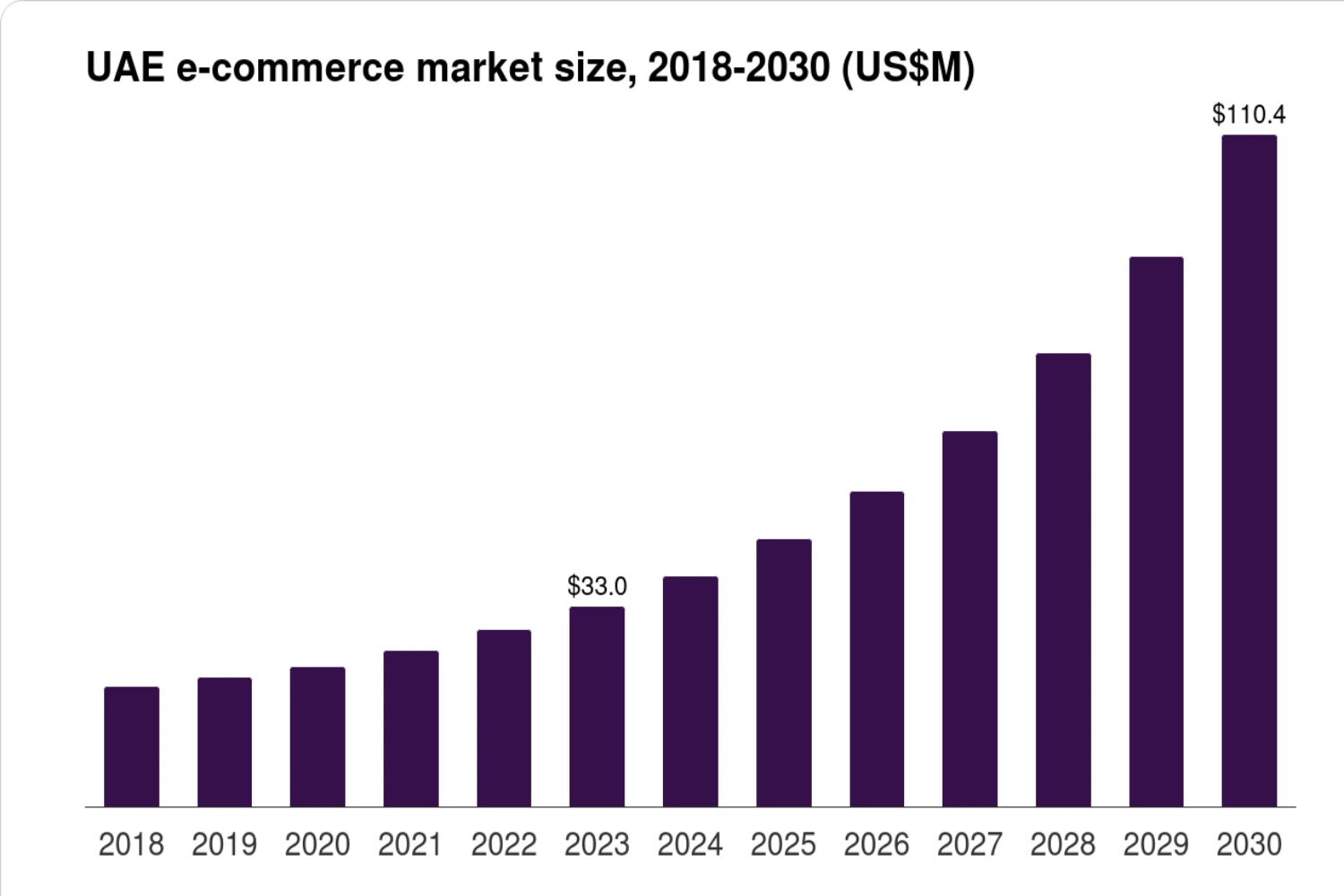

Expected market volume of US $8.55 billion by 2030 (CAGR 2.67%)

Between 2025 and 2030, the UAE’s eCommerce market is expected to grow at a 2.67 percent compound annual growth rate (CAGR), reaching US $8.55 billion. The steady rise shows consistent consumer demand and support from the government for digital transformation.

UAE eCommerce market valued US $11.05 billion in 2025 and US $20.54 billion by 2030 (CAGR 12.39 percent)

Another forecast places the market value even higher, with US$11.05 billion in 2025 and a projected US $20.54 billion by 2030. This estimate, based on a 12.39 percent CAGR, suggests faster growth through strong consumer spending and ongoing investment in digital trade.

Dubai Chamber forecasts US $8 billion in eCommerce sales by 2025

The Dubai Chamber of Commerce predicts that eCommerce sales will reach US $8 billion by 2025. The country’s internet and mobile access supports this growth, allowing customers to shop anywhere at any time.

Market growth of 53 percent in 2020, reaching US $3.9 billion (10 percent of total retail)

In 2020, the UAE recorded a 53 percent jump in eCommerce sales, totaling US $3.9 billion. Online shopping made up 10 percent of the country’s total retail sales that year. This was a turning point that pushed more businesses to move online.

Business Models and Segments

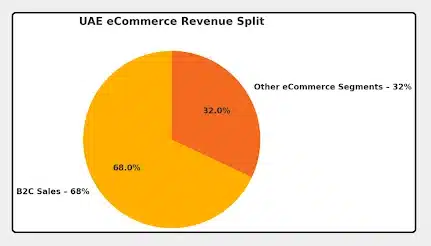

B2C segment held 68 percent of market revenue in 2024

In 2024, business-to-consumer (B2C) sales made up 68 percent of the UAE’s total eCommerce revenue. This shows how most online activity comes from direct sales to customers through digital stores and apps..

B2B segment expected to grow at 19.5 percent CAGR through 2030

The business-to-business (B2B) sector is growing even faster. It is expected to expand at a 19.5 percent CAGR by 2030. Many companies in the UAE are moving their procurement and supply processes online to save time and reduce costs. This shift shows that eCommerce is not just for retail customers but also for enterprises that want digital efficiency.

Product Categories

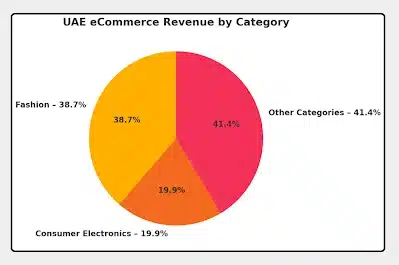

Fashion category held 22 percent share and generated 38.7 percent of revenue in 2024

Fashion remains the largest product category in the UAE’s eCommerce market. It held a 22 percent market share and produced 38.7 percent of total revenue in 2024. Popular global and local brands, influencer marketing, and easy return policies make fashion one of the most active online segments.

Consumer electronics formed 19.9 percent of revenue in 2024

Consumer electronics made up 19.9 percent of total eCommerce revenue in 2024. The UAE’s tech-savvy shoppers, especially young males, prefer buying gadgets and smart devices online because of better discounts, product variety, and reliable delivery.

Food and Beverage sector advancing at 15.2 percent CAGR to 2030

The food and beverage category is expanding fast with a 15.2 percent CAGR expected through 2030. The rise of quick commerce, meal delivery apps, and social media food trends has encouraged more customers to order groceries and meals online instead of visiting stores.

Beauty and personal care projected to reach US $1 billion sales by 2025

The beauty and personal care segment is also growing and is expected to reach US $1 billion in online sales by 2025. This growth comes from increasing awareness of self-care products and the strong presence of international beauty brands online.

Home-furnishing demand rising with real-estate growth upto AED 19.3 billion

The real estate boom, marked by Emaar’s AED 19.3 billion (US $5.26 billion) property sales in the first quarter of 2025, has led to higher home-furnishing and décor purchases online. As more residents move into new homes, eCommerce platforms offering furniture and home essentials are seeing steady demand.

Devices and Technology

Smartphones accounted for 79 percent of sales in 2024

Smartphones are the main shopping device in the UAE. In 2024, they made up 79 percent of total eCommerce sales. Most online stores are now optimized for mobile screens, and many shoppers prefer quick purchases through apps instead of desktop sites.

Connected devices growing at 18.1 percent CAGR

Smart TVs, voice assistants, and other connected devices are slowly becoming new ways to shop online. This segment is expected to grow at an 18.1 percent CAGR, showing how smart homes and digital lifestyles are shaping the next phase of eCommerce.

Desktop remains important for complex B2B catalogs

While mobile dominates, desktop computers still play a key role in B2B transactions. Many businesses use desktop platforms for detailed catalogs, bulk orders, and comparison tools that are easier to manage on larger screens.

Payment Trends

Digital wallet use reached 53 percent in 2024 with UAE Pass support

Digital wallets became more popular, reaching 53 percent penetration in 2024. The use of UAE Pass and biometric verification made online payments easier and safer. These tools reduce checkout steps and build user trust in digital payments.

67 percent of consumers prefer credit or debit cards for online payments

UAE consumers say they prefer paying online using credit or debit cards is about 67 percent . The habit shows how digital finance has replaced cash in most transactions, especially for young and tech-friendly shoppers.

86 percent feel confident about digital payment security

Trust plays a big role in payment adoption. Around 86 percent of people in the UAE feel confident about online payment safety. Secure gateways, encryption, and government-backed authentication systems have made digital payments reliable across platforms.

Consumer Behavior

58 percent of online purchases made from overseas vendors

Around 58 percent of online shoppers in the UAE buy from overseas stores. Shoppers trust global websites because of secure payment systems, better product quality, and free or reliable international shipping options.

Online shoppers are under 34 years old counts for 94 percent; 82 percent are male

In 2024, 94 percent of UAE’s online shoppers were under 34, and 82 percent were male. This young and tech-aware group drives demand for fashion, electronics, and entertainment products. Their digital habits strongly influence how the eCommerce market grows.

High-income expatriates drive online luxury and tech spending

The UAE’s expatriate population makes up 88 percent of the total population. Many of them are high-income professionals who buy luxury goods, electronics, and eco-friendly products online. Their spending power and preference for premium brands keep the high-value segment active.

Festivals and national events increase eCommerce spending

Spending rises sharply during Ramadan, National Day, and other festivals. Retailers use these times to launch promotions, flash sales, and product bundles. These cultural and national events encourage customers to shop more online.

Platforms and Technology Providers

Shopify hosts 41.99 percent of UAE online stores

Shopify leads the UAE eCommerce platform market, powering 41.99 percent of all online stores. Its simple setup and wide range of themes make it popular among small and mid-sized businesses looking to sell products quickly.

WooCommerce supports 36.06 percent of stores

WooCommerce, which works with WordPress, powers 36.06 percent of UAE online stores. Many businesses use it because it offers flexibility, easy customization, and strong integration with local payment gateways.

Custom-built carts hold 7.12 percent share

About 7.12 percent of online stores in the UAE use custom-built shopping carts. Large retailers and enterprise brands prefer custom systems to get better control over website performance, design, and data management.

Wix and MakanE platforms gaining moderate adoption

Wix powers 4.84 percent of stores, and MakanE hosts 3.68 percent. These platforms are growing because they provide affordable and user-friendly options for new online sellers in the UAE market.

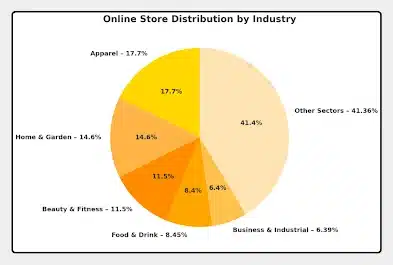

Online Store Distribution by Industry

The UAE eCommerce market covers a wide mix of industries. From fashion and home goods to beauty, electronics, and food, almost every sector has built a digital presence. The distribution of online stores shows which areas attract the most sellers and buyers.

- Apparel: Around 6.52K stores, accounting for 17.7 percent of all online stores. Fashion leads the market due to strong youth demand and social media influence.

- Home and Garden: About 5.37K stores (14.6 percent). Growth comes from rising home ownership and interior design interest.

Beauty and Fitness: Around 4.25K stores (11.5 percent). The segment benefits from increasing awareness of health and personal care. - Food and Drink: Nearly 3.11K stores (8.45 percent). Quick-delivery apps and online grocery platforms continue to expand.

- Business and Industrial: Around 2.36K stores (6.39 percent). Many B2B suppliers now sell products and materials through eCommerce platforms.

- Other Sectors: The remaining 22.33 percent include categories like electronics, travel, autos, and healthcare. This share shows how diverse and competitive the UAE online retail space has become.

Market Leaders

The UAE eCommerce market features a few strong players that shape online retail growth. These companies lead in sales, logistics, and digital innovation. Their wide product ranges and trusted delivery systems make them household names across the country.

- Amazon.ae earned about US $499 million in revenue in 2024, holding a strong position as the largest online marketplace in the UAE.

- Namshi recorded US $249 million in sales in 2024, mainly from fashion and lifestyle products.

- Noon achieved US $169 million in revenue and secured US $2 billion in new funding to improve its same-day delivery network and product range.

Other major players include Noon AD Holdings Ltd, Sharaf DG LLC, LetsTango.com, Amazon Inc. (Amazon.ae), and Namshi General Trading LLC. The UAE market remains moderately concentrated, with these few brands accounting for most online sales, while smaller niche stores continue to grow through social and mobile channels.

Logistics and Delivery

Non-metro deliveries consume 15–25 percent of basket value

Deliveries outside major cities can absorb 15 to 25 percent of the total order value. The higher cost comes from longer routes, fewer fulfillment centers, and limited transport options in remote areas.

Dense urban deliveries cost 3–5 percent of basket value

In major urban centers, such as Dubai and Abu Dhabi, delivery costs are lower—only 3 to 5 percent of the basket value. Dense populations and optimized delivery routes make city logistics more efficient and affordable for eCommerce firms.

Dubai offers same-day delivery to 90 percent of its urban population

Dubai leads the region in delivery speed. Same-day delivery now covers 90 percent of the city’s urban population. This has been made possible through advanced AI routing systems and local fulfillment hubs supported by free-zone incentives.

Government targets a 20 percent reduction in logistic and procedural costs

The UAE government aims to cut procedural and logistics costs by 20 percent as part of its digital economy plan. These improvements are designed to attract more eCommerce companies and make operations smoother for both local and international sellers.

Demographics and Connectivity

UAE population stands at 10.48 million with 64 percent male

The UAE’s population is 10.48 million, and 64 percent are male. This imbalance shapes online shopping trends, as male consumers dominate categories like electronics, automotive accessories, and fitness products.

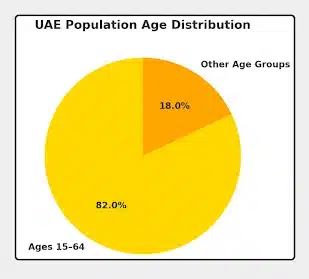

82 percent of the population is between 15 and 64 years old

About 82 percent of people in the UAE fall within the 15–64 age group. This working-age population is highly active online and contributes to consistent digital spending across multiple product categories.

Nearly 100 percent internet and mobile access nationwide

The UAE has almost full internet and mobile coverage, giving residents easy access to eCommerce platforms. High smartphone use, fast 5G networks, and affordable data plans encourage people to shop, compare prices, and pay online with confidence.

Final Words

The UAE’s eCommerce market in 2025 stands out as one of the strongest and most digitally advanced in the Middle East. Almost every sector—from fashion and electronics to food delivery and home décor—has built a stable online presence supported by high internet use and consumer trust in digital payments.

Mobile commerce continues to dominate, while card and wallet payments remain the top choices for most shoppers. Young, tech-driven consumers and high-income expatriates are shaping shopping patterns, pushing brands to offer faster, safer, and more personalized experiences.

The government’s ongoing focus on logistics efficiency, innovation, and cost reduction is helping both local and global companies grow online. With strong digital infrastructure, supportive policies, and rising consumer confidence, the UAE’s eCommerce market is set for steady expansion and deeper integration into everyday life.

Data Sources

- https://www.statista.com/outlook/emo/ecommerce/united-arab-emirates

- https://www.trade.gov/country-commercial-guides/united-arab-emirates-ecommerce

- https://www.mordorintelligence.com/industry-reports/united-arab-emirates-ecommerce-market

- https://www.aftership.com/ecommerce/statistics/regions/ae#united-arab-emirates-total-online-stores-by-industry

- https://knowledge.antom.com/the-uae-e-commerce-payment-trends-report-where-expat-wealth-meets-digital-innovation

Article By

Asif Hasan

Asif Hasan is a recognized expert in textile artistry, global sourcing, and e-commerce growth within the hand-knotted rugs and carpets sector. As the CEO of Ramsha Home, he focuses on preserving traditional weaving techniques while implementing modern digital strategies to bring authentic, high-quality floor coverings from artisan workshops to global customers. He specializes in optimizing the carpet supply chain and ensuring the sustainable trade of premium home textiles.

0

0