Blog

The home decor market is expanding as people invest more in making their homes stylish, functional, and comfortable. Factors such as rising urbanization, higher disposable income, and growing online furniture sales are driving this growth.

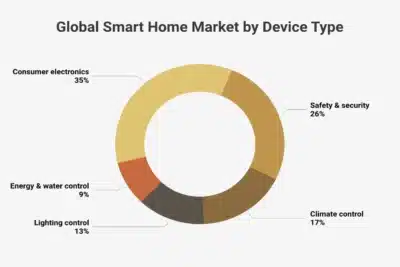

Consumers are shifting toward sustainable materials, smart-home décor, and modern design trends that blend beauty with practicality.

From furniture and lighting to textiles and carpets, every product category shows steady demand worldwide.

Regional markets like Asia-Pacific and the UAE are leading in innovation and digital adoption. This article highlights key statistics, market performance, and trends shaping the home decor industry in 2025.

Global Home Decor Market Statistics

What is the size of the global home decor market in 2025?

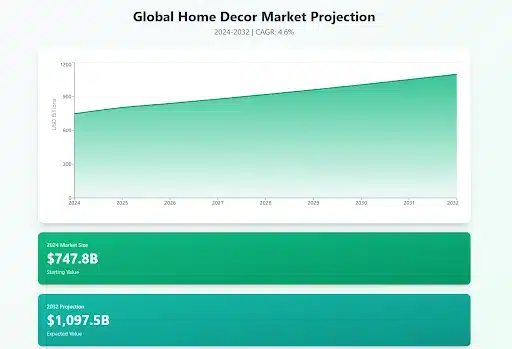

According to Fortune Business Insights, the global home decor market was about USD 747.8 billion in 2024, expected to rise to USD 802.3 billion in 2025, and reach USD 1,097.5 billion by 2032 at a CAGR of around 4.6%.

The global market continues to expand due to changing lifestyle preferences, rapid urbanization, and the rise of interior design awareness. Growth in the housing and construction sectors also contributes to higher spending on furniture, lighting, and decorative accessories. Overall, the industry shows stable long-term growth supported by both developed and emerging regions.

Which region dominates the global home decor market?

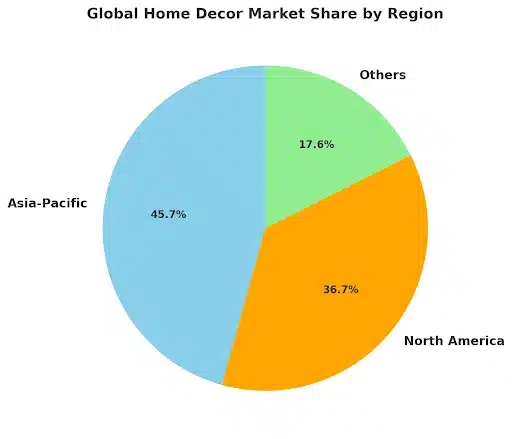

Asia-Pacific led the global market with about 45.7% share in 2024, followed by North America, which held around 36.7% share in the same year.

The Asia-Pacific market is growing due to rapid urbanization, new residential projects, and strong demand for modern, space-saving furniture in China, India, and Southeast Asia. China remains a major contributor, with 66.2% of its population living in cities in 2023, expected to reach 75–80% by 2035.

In North America, home decor spending remains high as consumers frequently renovate and upgrade their interiors. The U.S. continues to lead the region, with most households taking on home improvement projects every three to five years.

What are the major product categories in the home decor market?

The furniture segment dominated the global market with a 50.7% revenue share in 2024, as reported by Fortune Business Insights. The floor coverings segment held a 36.2% share in 2024, according to Mordor Intelligence. The textiles segment, including curtains, bed linen, and upholstery, is projected to record the fastest growth from 2025 to 2030.

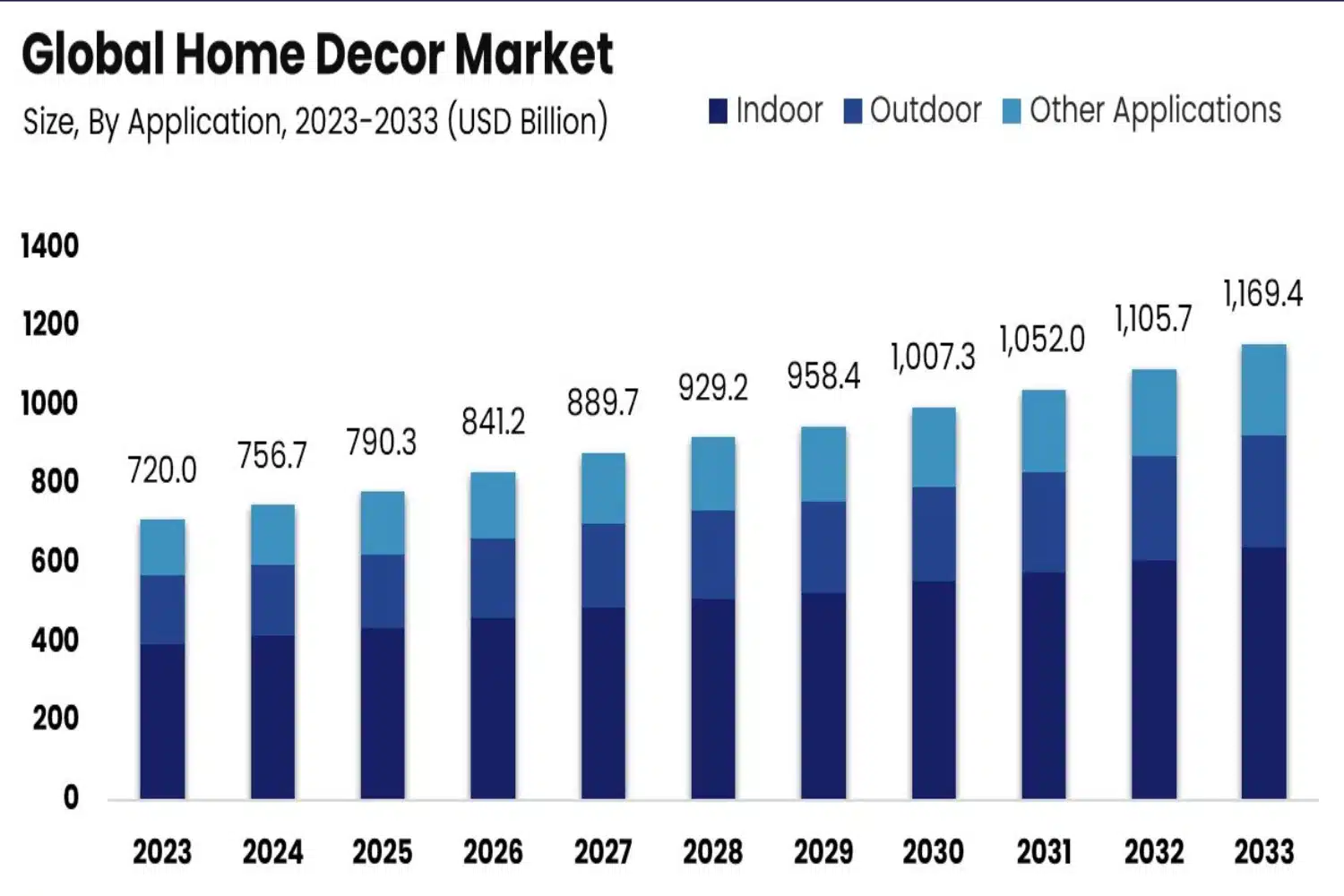

The indoor décor category accounted for 92.6% of total market revenue in 2022, showing the dominance of indoor living spaces such as living rooms, bedrooms, and kitchens. The retail store channel remains the largest distribution mode with a 41.7% share, based on Future Market Insights, while online channels continue to grow rapidly.

This strong performance reflects steady demand for functional and stylish home products, driven by consumer focus on comfort, space efficiency, and aesthetics.

What trends are shaping the global home decor market in 2025?

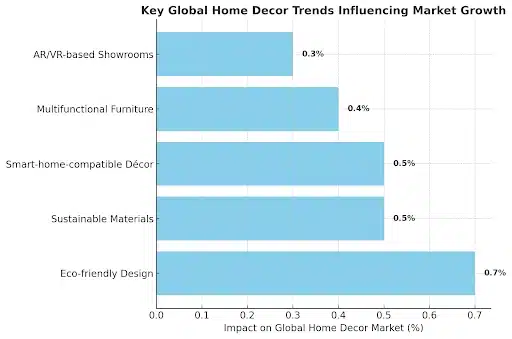

According to Mordor Intelligence, global home decor trends are influenced by eco-friendly design (+0.7%), sustainable materials, smart-home-compatible décor (+0.5%), multifunctional furniture (+0.4%), and the growing use of AR/VR-based showrooms (+0.3%).

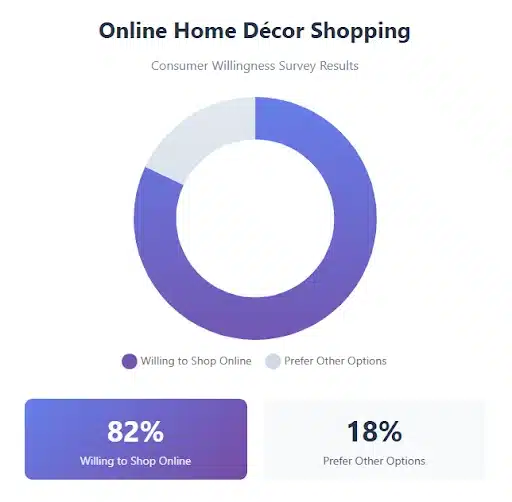

A survey shows that over 82% of consumers are willing to shop for home décor online, though 42% feel overwhelmed by too many product options.

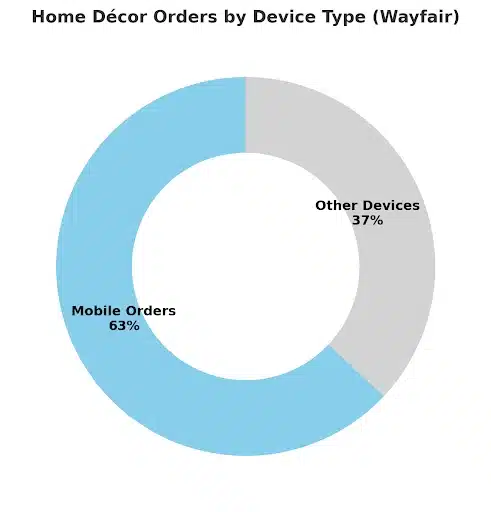

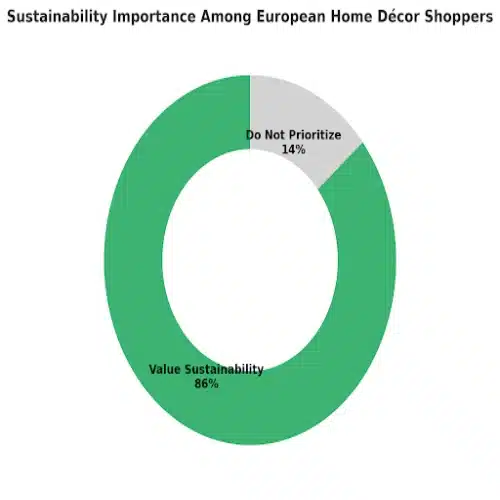

Wayfair reported that 63% of its orders came from mobile devices, and IKEA U.S. generated USD 1.9 billion in online revenue. In Europe, 86% of shoppers now consider sustainability important when choosing home décor items.

These figures highlight how digital engagement and sustainability are shaping buying behavior. Consumers now prefer eco-friendly, tech-integrated, and space-saving home designs that fit modern lifestyles.

How are key global companies performing in the home decor market?

Williams-Sonoma achieved a 21.5% operating margin and a 3.1% rise in brand sales in Q4 2024. Home Depot expanded its décor assortment, though furnishings account for only 4% of its USD 152 billion revenue.

Mass-market offerings make up 61.2% of the total market share, showing that consumers continue to prefer affordable, value-based products. Mordor Intelligence also noted that North America accounts for 42.5% of global home décor share due to higher income levels and a strong DIY culture.

These results show that both premium and value-focused brands are benefiting from rising home improvement demand, digital sales channels, and design-focused consumer preferences.

UAE Home Decor Market Statistics

What is the size of the home decor market in the UAE?

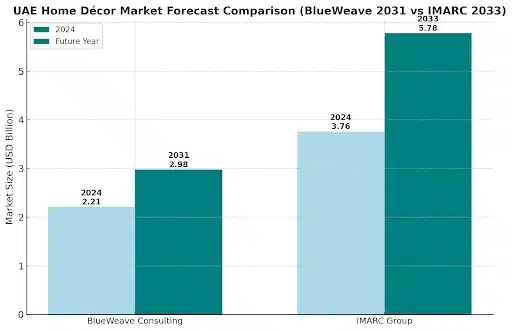

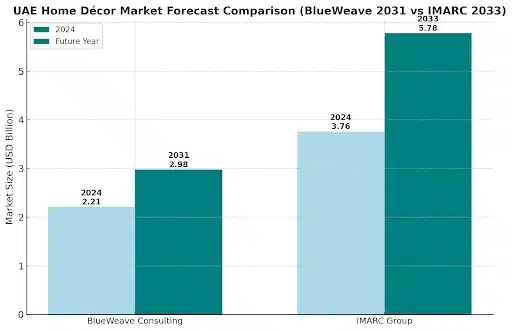

According to BlueWeave Consulting, the UAE home decor market was valued at USD 2.21 billion in 2024 and is projected to reach USD 2.98 billion by 2031, growing at a CAGR of 4.38%. Another report by IMARC Group estimated the UAE home decor market at around USD 3.76 billion in 2024, with expected growth to USD 5.78 billion by 2033, at a CAGR of 3.89%.

Data from Statista shows that revenue in the UAE home decor segment is USD 574.18 million in 2025, with a modest annual growth rate of 0.35% (2025–2030).

These reports show a strong and growing market, though figures vary based on the scope of study. Broader estimates include all furniture, textiles, and decorative items, while narrower data reflects only retail or online sales. Overall, steady growth is expected as home decoration spending continues to rise in both premium and mid-range categories.

Which product segments dominate the UAE home decor market?

The furniture segment leads the UAE market. According to IMARC Group, the UAE home furniture market stood at USD 2.19 billion in 2024 and is forecasted to reach USD 3.09 billion by 2033. Mordor Intelligence provides a similar outlook, projecting USD 2.78 billion in 2025 to USD 3.42 billion by 2030.

Carpets and floor coverings are also important product categories. The UAE carpet market was valued at USD 0.325 billion in 2024, with an expected increase to USD 0.394 billion by 2033.

These figures confirm that furniture and carpets together account for a large share of the UAE home decor spending, driven by new housing, renovation projects, and the rising popularity of luxury interior design.

How is online shopping changing the UAE home decor industry?

The UAE is one of the leading e-commerce markets in the GCC. The International Trade Administration reported a 53% jump in e-commerce in 2020, reaching USD 3.9 billion in sales, which represented 10% of total retail sales.

The Dubai Chamber of Commerce and Industry predicts that UAE e-commerce sales will reach USD 8 billion by 2025, driven by near 100% internet and smartphone access among residents.

In the home decor segment, the UAE online luxury home décor retail market is valued at around USD 1.2 billion, according to Ken Research, with Dubai and Abu Dhabi leading in both supply and demand.

These insights show that digital adoption is transforming how consumers buy home decor. Easy online access, virtual showrooms, and social media promotion have made premium and designer home decor more accessible than ever before.

What factors are driving the home decor market in the UAE?

Several factors contribute to the UAE’s growing home decor market:

- Expansion in the real estate and housing sector, especially in Dubai and Abu Dhabi

- Rapid urbanization and increased residential construction

- High internet and mobile penetration, supporting e-commerce growth

- Rising preference for luxury and designer furniture brands

- Shift toward eco-friendly materials and sustainable products

The market is also affected by trade policies and tariff changes. In the future, tariffs on some home decor products may rise by up to 12%, which could impact pricing and profitability. However, the country’s strong retail infrastructure and growing population continue to make it one of the most active home decor markets in the Middle East.

Summary and Conclusion

The global home decor market continues to grow, supported by rising urbanization, digital retail, and changing consumer lifestyles. Reports show steady expansion from 2024 to 2032, with furniture, floor coverings, and textiles leading overall revenue. Asia-Pacific remains the largest regional market, while North America follows with high spending on home renovation and design upgrades.

Consumers are more focused on sustainability, smart-home compatibility, and multifunctional furniture. Online sales keep rising as most shoppers now prefer digital platforms for convenience and variety. Leading brands like IKEA, Wayfair, and Williams-Sonoma show strong online performance and consistent growth.

In the UAE, the market reflects similar global patterns. Growth is driven by luxury housing, digital adoption, and consumer preference for premium home furnishings. Reports from BlueWeave Consulting, IMARC Group, and Mordor Intelligence confirm continued expansion through 2030 and beyond.

Overall, both global and UAE home decor markets are expected to maintain positive growth, supported by innovation, e-commerce, and the ongoing shift toward modern, sustainable living spaces.

Data Sources

- https://www.statista.com/outlook/cmo/furniture/homedecor/worldwide

- https://www.statista.com/outlook/cmo/furniture/home-decor/united-arab-emirates

- https://www.skyquestt.com/report/home-decor-market

- https://www.futuremarketinsights.com/reports/home-decor-market

- https://www.fortunebusinessinsights.com/home-decor-market-109906

- https://www.kenresearch.com/uae-online-luxury-home-decor-retail-market

- https://www.mordorintelligence.com/industry-reports/home-decor-market

FAQs: Home Decor Market Statistics 2025

1. What is the size of the global home decor market in 2025?

The global home decor market stands at about USD 802 billion in 2025 and is expected to grow steadily, reaching nearly USD 1.09 trillion by 2032, according to multiple reports. This growth is supported by higher living standards, housing expansion, and growing demand for stylish, functional home interiors.

2. Which region leads the global home decor market?

Asia-Pacific leads the global home decor market with about 45–46% share, followed by North America at around 37%. Growth in Asia-Pacific comes from rapid urbanization in China and India, while North America benefits from frequent home renovation and strong spending on design upgrades.

3. What is the largest product segment in home decor?

Furniture is the largest and fastest-growing product category, making up more than 50% of total revenue. Consumers continue to invest in living room and bedroom furniture, while floor coverings and textiles like curtains and linens also see strong demand.

4. How fast is the UAE home decor market growing?

The UAE home decor market is valued between USD 2.2 and 3.7 billion in 2024 and is projected to grow at a CAGR of around 3.8–4.4% through 2031. Growth comes from rising luxury housing, modern interiors, and an expanding online retail sector led by cities like Dubai and Abu Dhabi.

5. What trends are shaping the home decor market in 2025?

Major trends include eco-friendly materials, smart-home-compatible décor, and multifunctional furniture. Digital channels, including AR/VR showrooms and mobile shopping, are also reshaping how consumers discover and buy home decor products globally.

6. How often do consumers update their home decor?

Most consumers, especially in developed markets, refresh their home decor every 3–5 years. Frequent updates are driven by changing design trends, online inspiration, and seasonal sales that make home upgrades easier and more affordable.

Article By

Asif Hasan

Asif Hasan is a recognized expert in textile artistry, global sourcing, and e-commerce growth within the hand-knotted rugs and carpets sector. As the CEO of Ramsha Home, he focuses on preserving traditional weaving techniques while implementing modern digital strategies to bring authentic, high-quality floor coverings from artisan workshops to global customers. He specializes in optimizing the carpet supply chain and ensuring the sustainable trade of premium home textiles.

0

0